how are rsus taxed at ipo

RSUs or Restricted Stock Units trigger ordinary. How do employees handle income taxes on pre-ipo vested rsus.

Restricted Stock Units Jane Financial

This online calculator allows you to estimate both federal and state taxes due to an IPO or vested RSUs and is especially useful as it takes into account capital gains deductions and existing tax.

. So if you had 10000 RSUs youd actually receive only 7800. Depends a lot on the grant and the company but if theyre RSUs they dont have a price. The fair market value of RSUs is taxable as ordinary income on the date that shares are actually transferred to.

Yet all the RSUs are released fully on that day and you owe taxes. Yet all the RSUs are released fully on that day and you owe taxes. Answer 1 of 2.

They turn into shares ifwhen they fully vest. That said in general the. Any vesting schedule you signed up for.

Since Facebooks IPO other private tech giantsboth unicorns and non-unicornshave followed suit. That means every month 22 of your 10 shares in Equity R Us are actually withheld from you for tax purposes. The company will take.

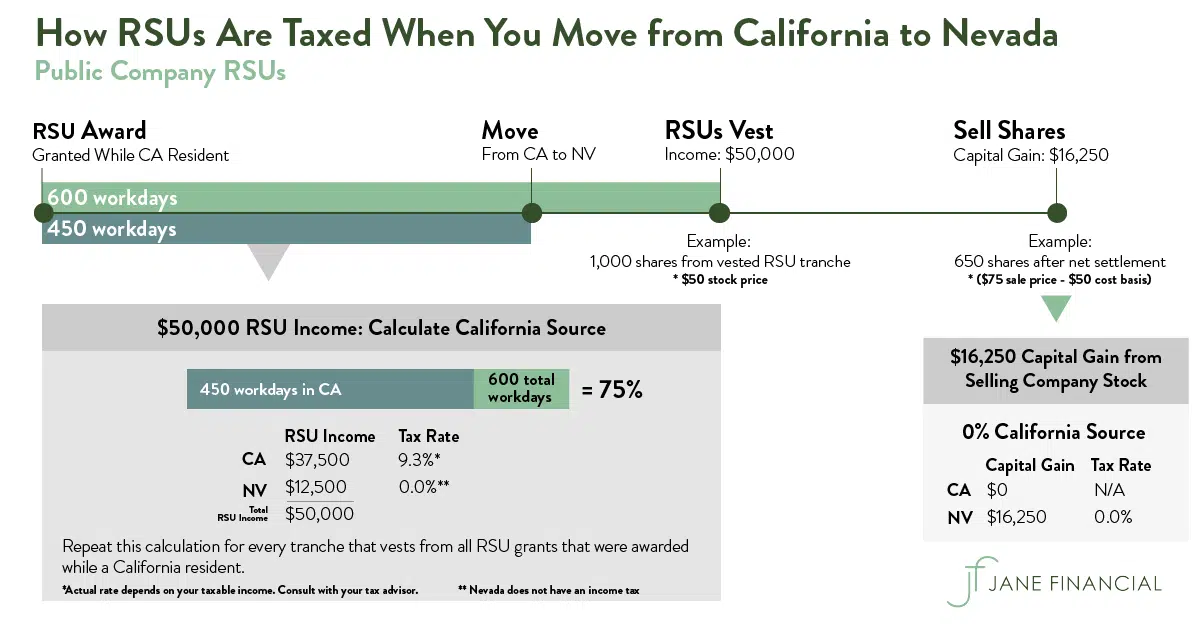

As with all aspects of taxation specifics will depend on your specific circumstances and should be reviewed with a tax professional. As the private company matures and moves toward an IPO or acquisition equity grants tend to shift toward restricted stock. In examples like Airbnb Doordash etc.

RSUs will become more prevalent closer to an exit. Outside investors whove been wanting to purchase company equity can finally. At newly public companies grants made before the initial public offering IPO may also require a liquidity event ie the IPO itself to occur before the shares vest.

Typically employees need to pay attention to three specific ways that an IPO can impact their taxes. With RSUs you are taxed when the shares are delivered which is almost always at vesting. But Im pretty sure I havent been taxes on RSUs Ive received from a pre-IPO company.

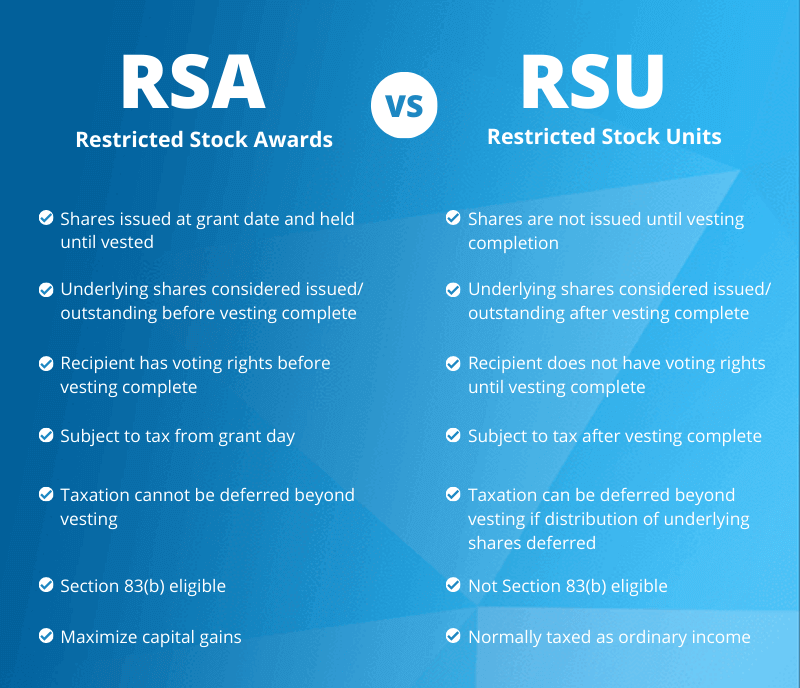

RSUs are a type of equity compensation where individuals own shares of common stock and receive them when certain conditions are met. Restricted Stock Units RSUs Jan 1. Expect RSUs In A Later-Stage Private Company.

Currently employers must withhold at least 22 of your RSUs and more if you have excess of 1 million in supplemental income. Once the liquidity event has. Are they double trigger vestliquidity event 83i or do employees have to pay taxes in.

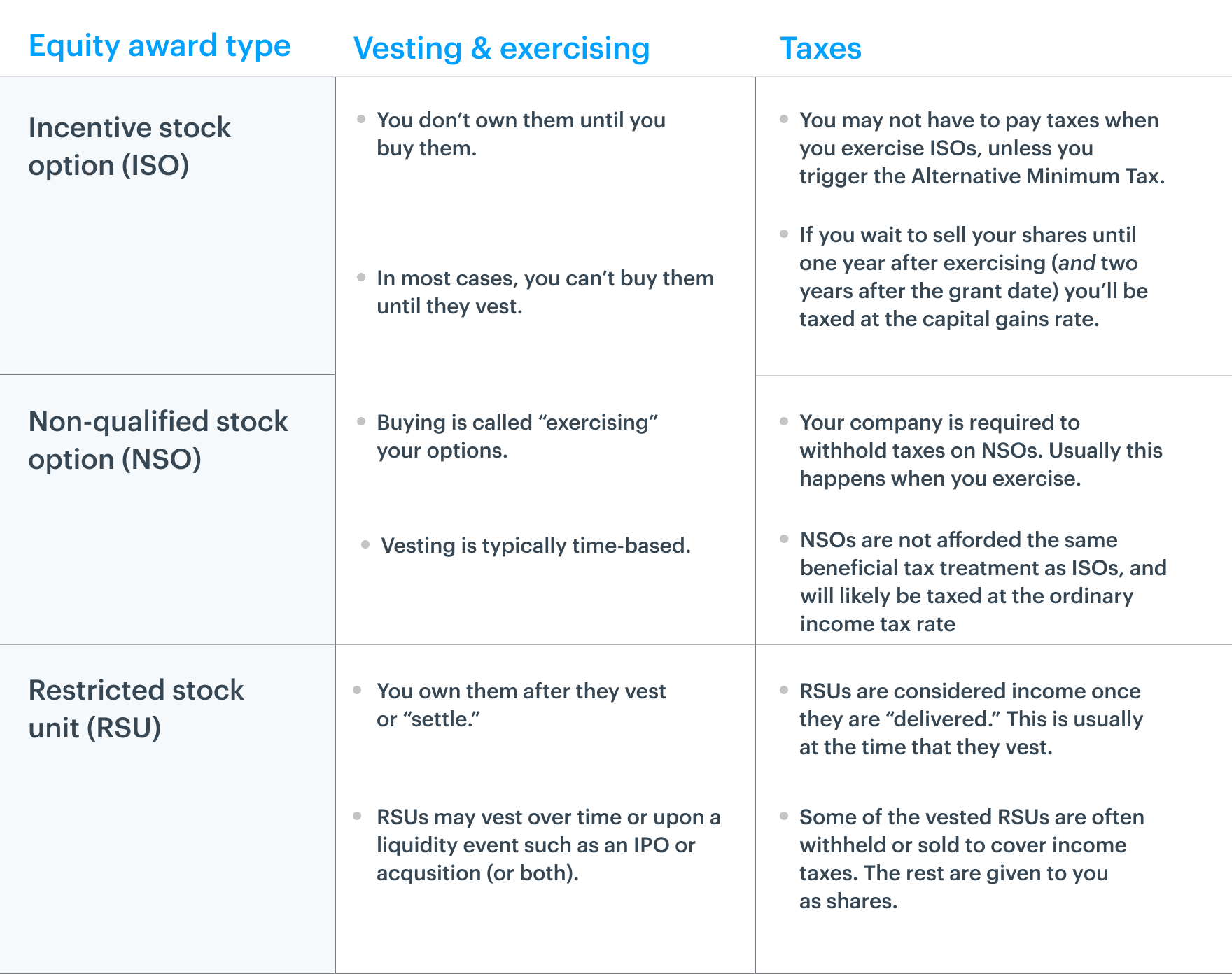

Take some time to map out different IPO timings and how that would affect your tax brackets. Without seeing all of the details of the award it is difficult to answer this question with certainty. The three most common forms of equity compensation will include incentive stock options ISOs non-qualified stock options NQSOs and restricted stock units RSUs.

Answer 1 of 3. Now companies do usually withhold the statutory 22 tax rate usually by withholding shares from. Double-trigger vesting was a major innovation to RSUs.

But Im pretty sure I havent. It gets a little tricky here because there are no cookie. IPOs are causing a lot of excitement.

Typically those conditions are timed. I will answer it based on what the majority of plans like this will require. Watch out for RSUs.

As tax season begins some of Ubers earliest employees are realizing they had little idea how their stock grants worked and are now. Robinhood just went IPO on July 28.

Restricted Stock Units Jane Financial

What Is A Restricted Stock Unit Rsu Everything You Should Know Carta

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Restricted Stock Units Jane Financial

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Rsa Vs Rsu All You Need To Know Eqvista

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

Should I Withhold 22 Or 37 On My Rsus When My Company Goes Public Flow Financial Planning Llc

Restricted Stock Units Jane Financial

How Equity Holding Employees Can Prepare For An Ipo Carta

Restricted Stock Units Jane Financial

Should I Withhold 22 Or 37 On My Rsus When My Company Goes Public Flow Financial Planning Llc

Tax Planning For Stock Options

Avoiding The 1 Million Tax Trap New Section 162 M Regulations Affect Use Of Rsus By Ipo Companies Compensia