owners draw report in quickbooks online

Hover over the net income amount in the tile at the very top. At the bottom left choose Account New.

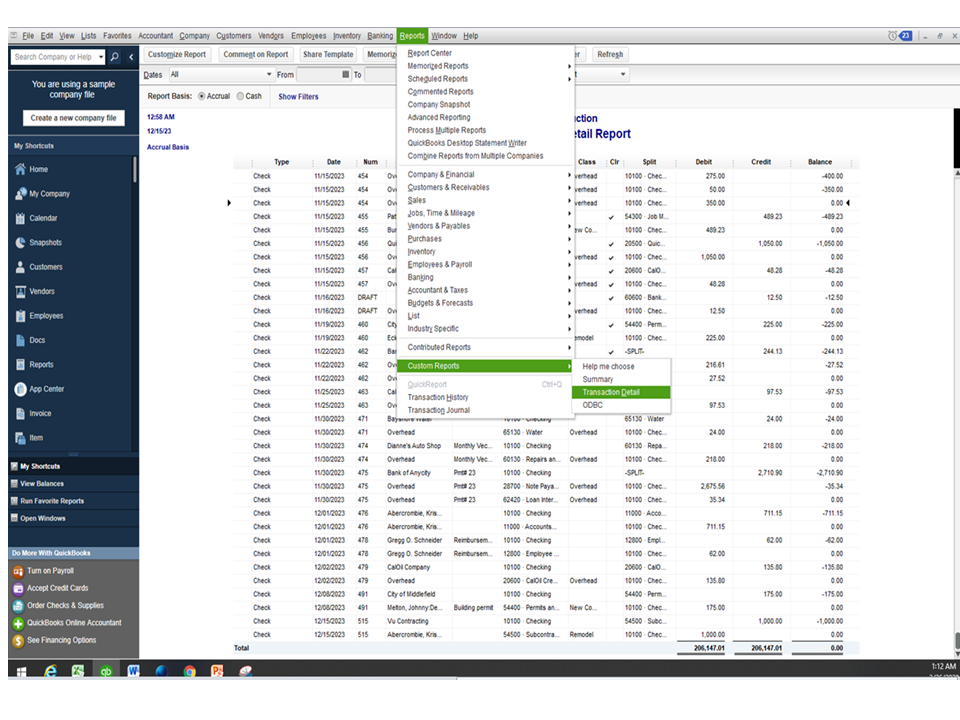

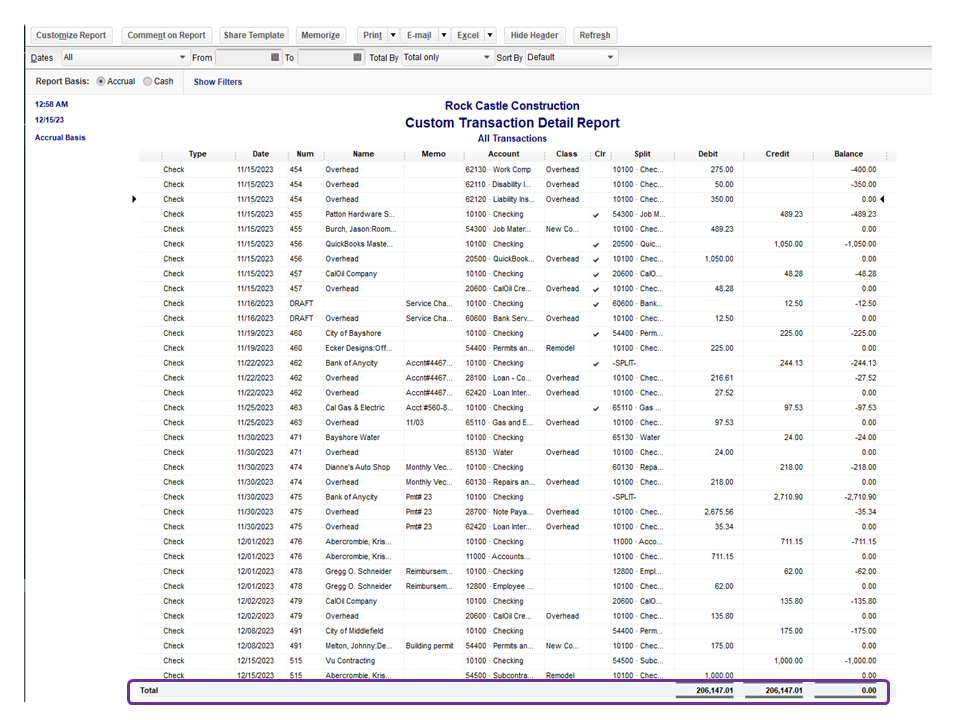

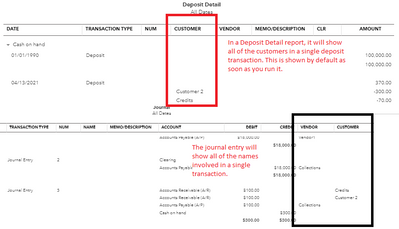

Solved How Do I Get Totals To Show Up On A Check Detail R

Go to the Account details section.

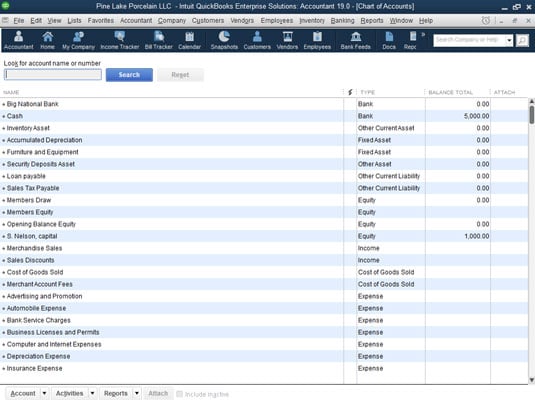

. Select Equity and Continue. In the ACCOUNT column enter Owners Equity or. Open the chart of accounts and choose Add Add a new Equity account and title it Owners Draws If there is more than one owner make separate draw accounts for each owner and name them by owner eg.

At the top click the Create menu and select Cheque or Expense. Set up draw accounts. Quickbooks bookkeeping cashmanagementIn this tutorial I am demonstrating how to do an owners draw in QuickBooks------Please watch.

QuickBooks Online September 10 2021 by. Click Save Close. 2 Create an equity account and categorize as Owners Draw.

Write Checks from the Owners Draw Account In QuickBooks Desktop software. QuickBooks Online In years past the business had a contractor who the owner married and for tax year 2021 they are business partners. Click Equity Continue.

Select Chart of Account under. How do I report an owners draw in QuickBooks. Click Equity Continue.

A members draw also known as an owners draw or a partners draw is a quickbooks account that records the amount taken out of a company by one of its owners along with the amount of the owners investment and the. Visit the Lists option from the main menu followed by Chart of Accounts. Fill in the check fields.

To create an owners draw account. Click the Expenses tab and then select the account category that best fits your needs. In fact the best recommended practice is to create an owners draw.

Heres how to do it. Say you withdraw 2000 from your company. Follow this procedure 1.

To create an owners draw account. At the bottom left choose Account New. An owners draw account is an equity account used by quickbooks online to track withdrawals of the companys assets to pay an owner.

Details Choose Lists Chart of Accounts or press CTRL A on your keyboard. From the PAY TO THE ORDER OF field select the vendors name. How do I pay an owners draw in QuickBooks online.

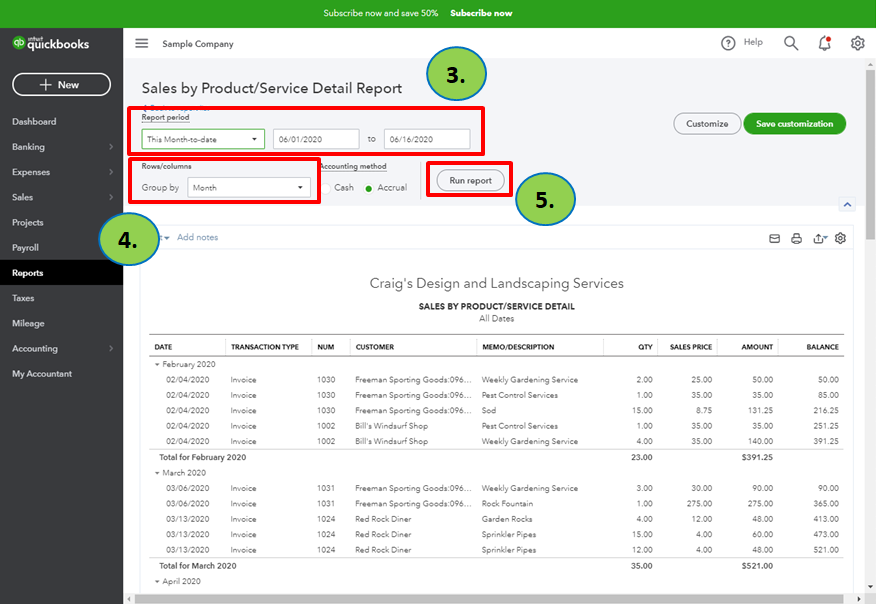

Would you simply categorize payments to this person as Owners Draw. To Write A Check From An Owners Draw Account the steps are as follows. Run a Profit and Loss Report in QuickBooks Online.

Enter the amount of the investment in the Amount input box. Any income you withdraw must be paid as dividends after-tax profit because a Corporation is not owned by you you own its shares which gives you 100 control. Select Print later if you want to print the check.

Select Save and then Done. Click Account New at the bottom left. As a business owner at least a part of your business bank account belongs to you.

To record owners draws you need to go to your Owners Equity Account on your balance sheet. Click Save Close. Tap the Gear icon and choose Account and Settings.

At the bottom of the Chart of Accounts page you should see an option titled Accounts click it and choose New. September 9 2021 by James Antonio. Choose Lists Chart of Accounts or press CTRL A on your keyboard.

To write a check from an owners equity account. Click on the Banking menu option. Only a sole proprietorship a partnership a disregarded entity LLC and a partnership LLC can have owner draws.

Go to Banking Write Checks. Enter the account name Owners Draw is recommended and description. In the Write Checks box click on the section Pay to the order of.

2 level 1 countsbeans 6y. Select the Bank Account Cash Account or Credit Card you used to make the purchase. Click Save and Close.

September 7 2021 by James. Now enter the amount followed by the symbol. Go to the Advanced tab and pick Categories.

In the Account field be sure to select Owners equity you created. Using Macros to Format in Excel for QuickBooks Reports. Record your owners draw by debiting your Owners Draw Account and crediting your Cash Account.

Youre allowed to withdraw from your share of the businesss value. Choose Lists Chart of Accounts or press CTRL A on your keyboard. 2021 by James Antonio.

At the bottom left choose Account New. Open the chart of accounts use run report on that account from the drop down arrow far right of the account name For a company taxed as a sole proprietor or partnership I recommend you have the following for ownerpartner equity accounts one set for each partner if a. How do you handle owner draws in QuickBooks.

On the QuickBooks dashboard the home screen go to the tile called Profit and Loss. Choose the bank account where your money will be withdrawn. Type your own name or the name of the co-owner who is making the investment in the Detail area.

In this section click on the Owner. To open an owners draw account follow these steps. Before you can record an owners draw youll first need to set one up in your Quickbooks account.

Enter the account name Owners Draw is recommended and description. This tutorial will show you how to record an owners equity draw in QuickBooks OnlineIf you have any questions please feel free to ask. Correspondingly how do I enter owner investments in QuickBooks.

Then choose the option Write Checks. Expenses VendorsSuppliers Choose New. Smith Draws Post checks to.

1 Create each owner or partner as a VendorSupplier. How to Setup and Pay Owners Draw in QuickBooks Online Desktop. Enter and save the information.

Enter an opening balance. Enter the account name and description Owners Draw is recommended. In QuickBooks Desktop software Click on the Banking menu option Then choose the option Write Checks In the Write Checks box click on the section Pay to the order of In this section click on the Owner Now enter the amount followed by the symbol.

Choose the Right Payment Gateway. Choose Lists Chart of Accounts or press CTRL A on your keyboard. September 9 2021.

Youll notice that your cursor becomes a. How do I record an owners distribution in QuickBooks. Enter the Amount.

At the end of the year or period subtract your Owners Draw Account balance from your Owners Equity Account total. Click to select the company bank account in which you want to deposit the investment in the Make Deposits window. How do I show owners draw in Quickbooks.

Choose the Payee and the Bank Account used to withdraw the money. Select Save and Close. Answer 1 of 5.

Mark the Track classes to turn on class tracking.

Minutes Matter In The Loop Paying Amp Reimbursing Yourself In Quickbooks Chart Of Accounts Quickbooks Accounting

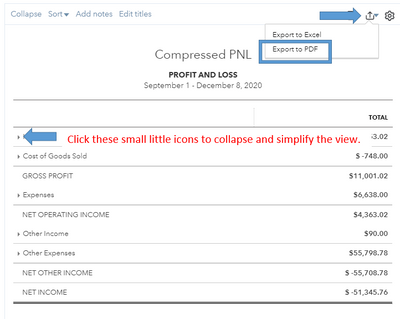

How To Create A Custom Report In Quickbooks Online Youtube

How To Save Customized Reports In Quickbooks Online Tutorial Youtube

Solved Custom Profit And Loss Report

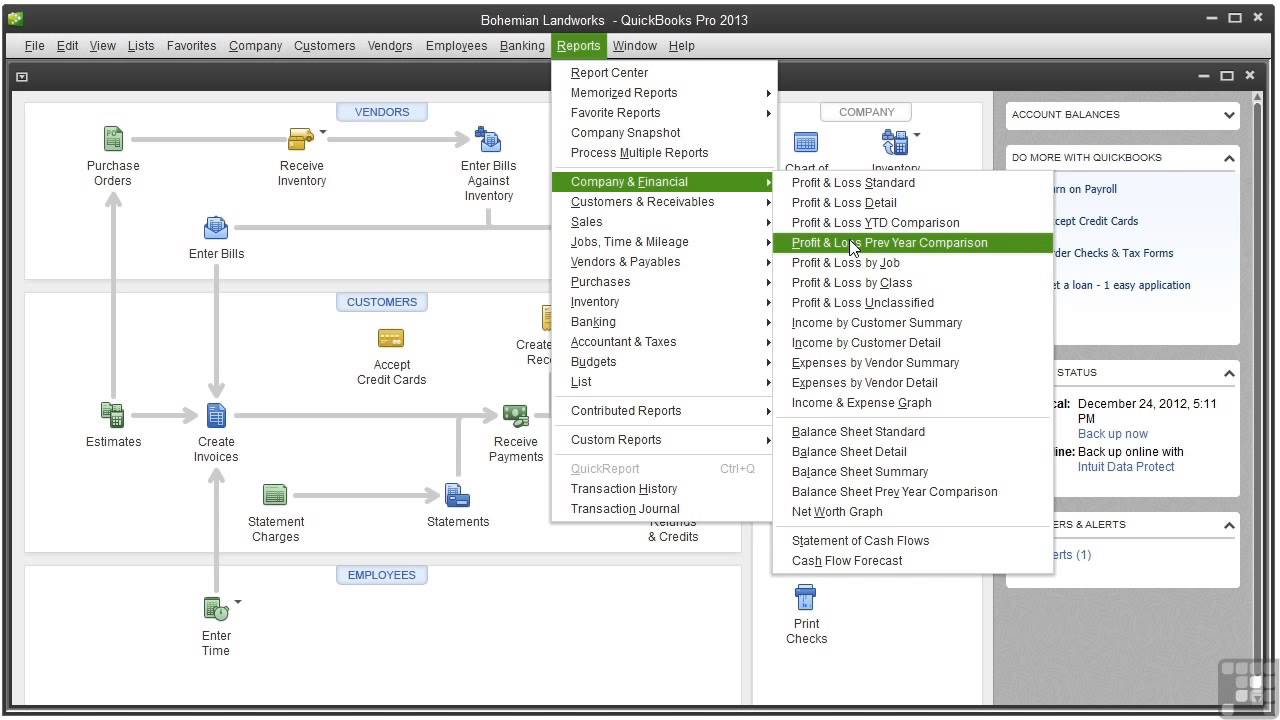

Quickbooks 2013 Tutorial Profit And Loss Report Youtube

Solved How Do I Get Totals To Show Up On A Check Detail R

5 Steps To Using Custom Fields In Quickbooks Online Advanced Firm Of The Future

How Do I Run A Month To Month Sales Revenues Comparison For 2018

Why Is My Quickbooks Profit And Loss Report Not Showing Owner S Draw Quickbooks Tutorial

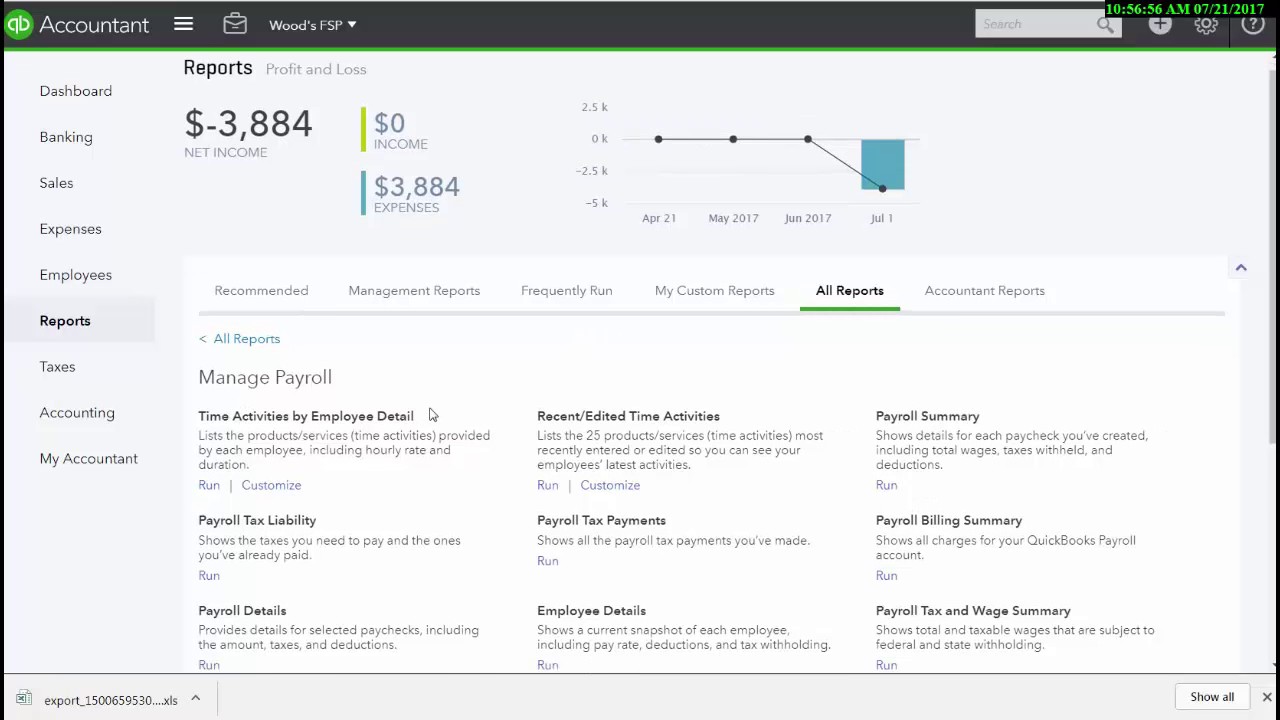

Quickbooks Online Full Service Payroll Report Navigation Youtube

Save Custom Reports In Quickbooks Online Instructions Quickbooks Online Quickbooks Best Templates

Onpay Payroll Services Review Payroll Software Payroll Advertising Methods

Quickbooks Help How To Create A Check Register Report In Quickbooks Inside Quick Book Reports Templates Great Cre Quickbooks Help Quickbooks Check Register

Solved How Do I Create A Custom Report For A Specific Account

Creating Custom Conditional Formatting Rules In Excel Resume Words Adding Numbers Excel

Double Entry Accounting Has Come To Freshbooks Small Business Accounting Accounting Double Entry

How To Set Up The Quickbooks 2019 Chart Of Accounts List Dummies